Page 34 - Bullion World Volume 5 Issue 06 June 2025

P. 34

Bullion World | Volume 5 | Issue 06 | June 2025

a possible deeper correction to $2,900 aligning • Long-term perspective: The outlook remains

with the .618 Fibonacci retracement—though this bullish through the next year and up to the APPMC

appears unlikely unless geopolitical tensions ease. 2026 event, with gold potentially trading between

$3,500 and $4,000. The worst-case scenario

envisages a decline to $2,600–$2,700, which is

presently improbable.

Silver: Industrial Demand Fuels Optimism

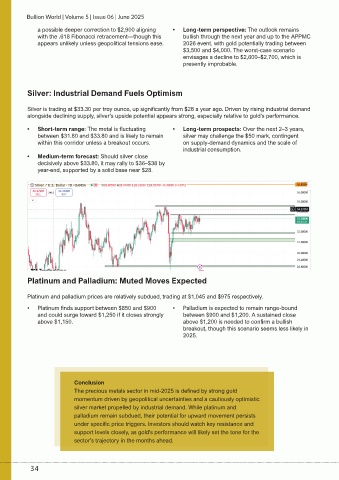

Silver is trading at $33.30 per troy ounce, up significantly from $28 a year ago. Driven by rising industrial demand

alongside declining supply, silver’s upside potential appears strong, especially relative to gold’s performance.

• Short-term range: The metal is fluctuating • Long-term prospects: Over the next 2–3 years,

between $31.80 and $33.80 and is likely to remain silver may challenge the $50 mark, contingent

within this corridor unless a breakout occurs. on supply-demand dynamics and the scale of The same,

industrial consumption.

• Medium-term forecast: Should silver close

decisively above $33.80, it may rally to $36–$38 by yet so different.

year-end, supported by a solid base near $28.

Platinum and Palladium: Muted Moves Expected

Platinum and palladium prices are relatively subdued, trading at $1,045 and $975 respectively.

• Platinum finds support between $850 and $900 • Palladium is expected to remain range-bound

and could surge toward $1,250 if it closes strongly between $900 and $1,200. A sustained close

above $1,150. above $1,200 is needed to confirm a bullish

breakout, though this scenario seems less likely in

2025.

Conclusion

The precious metals sector in mid-2025 is defined by strong gold

momentum driven by geopolitical uncertainties and a cautiously optimistic

silver market propelled by industrial demand. While platinum and

palladium remain subdued, their potential for upward movement persists

under specific price triggers. Investors should watch key resistance and

support levels closely, as gold’s performance will likely set the tone for the

sector’s trajectory in the months ahead.

34