Page 33 - Bullion World Volume 5 Issue 06 June 2025

P. 33

Bullion World | Volume 5 | Issue 06 | June 2025

Bullion World | Volume 5 | Issue 06 | June 2025

"Navigating 2025: Gold’s Rally and the

Future of Silver, Platinum & Palladium"

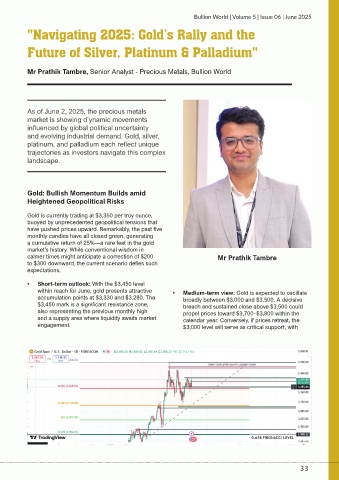

Mr Prathik Tambre, Senior Analyst - Precious Metals, Bullion World

As of June 2, 2025, the precious metals

market is showing d’ynamic movements

influenced by global political uncertainty

and evolving industrial demand. Gold, silver,

platinum, and palladium each reflect unique

trajectories as investors navigate this complex

landscape.

Gold: Bullish Momentum Builds amid

Heightened Geopolitical Risks

Gold is currently trading at $3,350 per troy ounce,

buoyed by unprecedented geopolitical tensions that

have pushed prices upward. Remarkably, the past five

monthly candles have all closed green, generating

a cumulative return of 25%—a rare feat in the gold

market’s history. While conventional wisdom in

calmer times might anticipate a correction of $200 Mr Prathik Tambre

to $300 downward, the current scenario defies such

expectations.

• Short-term outlook: With the $3,450 level

within reach for June, gold presents attractive • Medium-term view: Gold is expected to oscillate

accumulation points at $3,330 and $3,280. The broadly between $3,000 and $3,500. A decisive

$3,450 mark is a significant resistance zone, breach and sustained close above $3,500 could

also representing the previous monthly high propel prices toward $3,700–$3,800 within the

and a supply area where liquidity awaits market calendar year. Conversely, if prices retreat, the

engagement. $3,000 level will serve as critical support, with

33

33