Page 28 - Bullion World Volume 5 Issue 07 July 2025

P. 28

Bullion World | Volume 5 | Issue 07 | July 2025

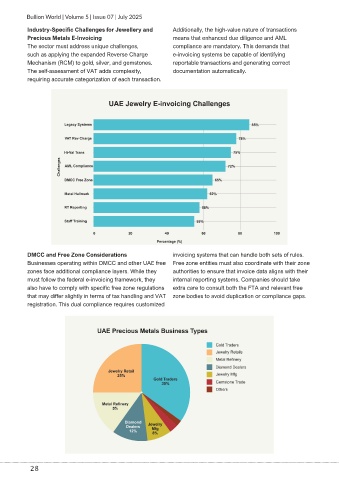

Industry-Specific Challenges for Jewellery and Additionally, the high-value nature of transactions

Precious Metals E-Invoicing means that enhanced due diligence and AML

The sector must address unique challenges, compliance are mandatory. This demands that

such as applying the expanded Reverse Charge e-invoicing systems be capable of identifying

Mechanism (RCM) to gold, silver, and gemstones. reportable transactions and generating correct

The self-assessment of VAT adds complexity, documentation automatically.

requiring accurate categorization of each transaction.

DMCC and Free Zone Considerations invoicing systems that can handle both sets of rules.

Businesses operating within DMCC and other UAE free Free zone entities must also coordinate with their zone

zones face additional compliance layers. While they authorities to ensure that invoice data aligns with their

must follow the federal e-invoicing framework, they internal reporting systems. Companies should take

also have to comply with specific free zone regulations extra care to consult both the FTA and relevant free

that may differ slightly in terms of tax handling and VAT zone bodies to avoid duplication or compliance gaps.

registration. This dual compliance requires customized

28