Page 26 - Bullion World Volume 5 Issue 07 July 2025

P. 26

Bullion World | Volume 5 | Issue 07 | July 2025

UAE E-Invoicing 2026:

Compliance Guide for Jewellery,

Refineries and Gold Traders

Mr Spencer Campbell, Director, SE Asia Consulting Pte Ltd

UAE E-Invoicing is transforming how businesses in the precious metals sector—including Jewellery

retailers, gold traders, refineries, and diamond dealers—manage compliance and digital operations. With

the UAE's Federal Tax Authority mandating e-invoicing for all VAT-registered businesses by July 2026,

it is crucial for companies to prepare now. This guide provides a comprehensive overview of what UAE

E-Invoicing means, the implementation timeline, challenges unique to the sector, and how to ensure your

business is ready for this digital leap.

Understanding UAE E-Invoicing: What Service Providers (ASPs) using the PEPPOL network.

Changes for Precious Metals Businesses The Decentralized Continuous Transaction Control and

E-invoicing in the UAE mandates a complete overhaul Exchange (DCTCE) model introduced by the FTA will

of traditional invoice processing. Businesses can no enforce real-time invoice reporting and verification,

longer use paper or PDF-based invoices; instead, they ensuring transparency and reducing the risk of VAT

must adopt structured XML or JSON formats. These evasion.

digital invoices must be transmitted through Accredited

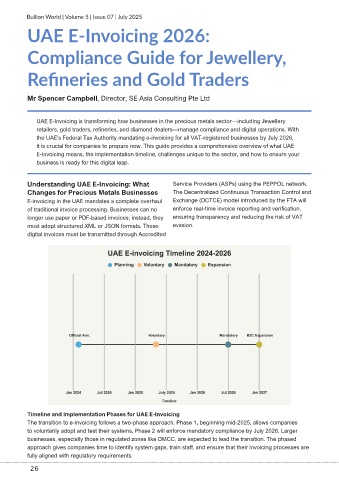

Timeline and Implementation Phases for UAE E-Invoicing

The transition to e-invoicing follows a two-phase approach. Phase 1, beginning mid-2025, allows companies

to voluntarily adopt and test their systems. Phase 2 will enforce mandatory compliance by July 2026. Larger

businesses, especially those in regulated zones like DMCC, are expected to lead the transition. The phased

approach gives companies time to identify system gaps, train staff, and ensure that their invoicing processes are

fully aligned with regulatory requirements.

26