Page 32 - Bullion World Volume 5 Issue 08 August 2025

P. 32

Bullion World | Volume 5 | Issue 08 | August 2025

Bullion World | Volume 5 | Issue 08 | August 2025

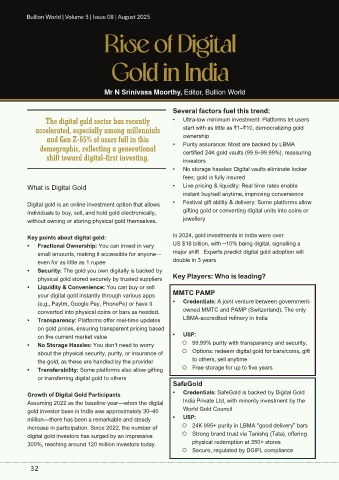

Rise of Digital

Gold in India

Mr N Srinivasa Moorthy, Editor, Bullion World

Several factors fuel this trend:

The digital gold sector has recently • Ultra-low minimum investment: Platforms let users

accelerated, especially among millennials start with as little as ₹1–₹10, democratizing gold

and Gen Z-65% of users fall in this ownership

demographic, reflecting a generational • Purity assurance: Most are backed by LBMA

certified 24K gold vaults (99.9–99.99%), reassuring

shift toward digital-first investing. investors

• No storage hassles: Digital vaults eliminate locker

fees; gold is fully insured

What is Digital Gold • Live pricing & liquidity: Real time rates enable

instant buy/sell anytime, improving convenience

Digital gold is an online investment option that allows • Festival gift ability & delivery: Some platforms allow

individuals to buy, sell, and hold gold electronically, gifting gold or converting digital units into coins or

without owning or storing physical gold themselves. jewellery

Key points about digital gold: In 2024, gold investments in India were over

• Fractional Ownership: You can invest in very US $18 billion, with ~10% being digital, signalling a

small amounts, making it accessible for anyone— major shift . Experts predict digital gold adoption will

even for as little as 1 rupee double in 3 years

• Security: The gold you own digitally is backed by

physical gold stored securely by trusted suppliers Key Players: Who is leading?

• Liquidity & Convenience: You can buy or sell

your digital gold instantly through various apps MMTC PAMP

(e.g., Paytm, Google Pay, PhonePe) or have it • Credentials: A joint venture between government-

converted into physical coins or bars as needed. owned MMTC and PAMP (Switzerland). The only

• Transparency: Platforms offer real-time updates LBMA-accredited refinery in India

on gold prices, ensuring transparent pricing based

on the current market value • USP:

• No Storage Hassles: You don’t need to worry { 99.99% purity with transparency and security.

about the physical security, purity, or insurance of { Options: redeem digital gold for bars/coins, gift

the gold, as these are handled by the provider to others, sell anytime

• Transferability: Some platforms also allow gifting { Free storage for up to five years

or transferring digital gold to others

SafeGold

Growth of Digital Gold Participants • Credentials: SafeGold is backed by Digital Gold

Assuming 2022 as the baseline year—when the digital India Private Ltd, with minority investment by the

gold investor base in India was approximately 30–40 World Gold Council

million—there has been a remarkable and steady • USP:

increase in participation. Since 2022, the number of { 24K 995+ purity in LBMA "good delivery" bars

digital gold investors has surged by an impressive { Strong brand trust via Tanishq (Tata), offering

300%, reaching around 120 million investors today. physical redemption at 350+ stores

{ Secure, regulated by DGIPL compliance

32

32