-

ROSS NORMAN : Speculative froth departing gold as China tightens trading conditions.

Tue April 23 2024

Not all buying is equal and that is becoming apparent to gold.

Arguably the physical buying interest from central banks as well as Chinese retail purchases underpinning this market could count as some of the highest quality in that neither is likely to return to the market irrespective of the price action.

The same cannot be said of the more recent speculative flows, which by their nature, are arguably agnostic to the asset itself … it's a pure exercise in making money. Long or short … gold or soda ash futures … who cares. Like 12 year olds high on e-numbers, the futures market can be a riot of activity, rife with rumour and everyone keen to jump on the latest fad.

If you marked the 'new gold paradigm' to 1st March 2024 before the yellow metal went near vertical … and showed little regard for neither financial market indicators nor geopolitics … then arguably the gold floor is comfortably set at around $2060. That said, physical buyers who missed the rally will likely jump in as the market retraces, setting a much higher floor. The charts offer some guidance – with the 100 dma at $2250 and this will likely be the first port of call … will it hold ? … that depends upon the level of long liquidation coming out of China, because that seems to be the driving force just now.

So China has tightened trading conditions as a safeguard in a gold market that it clearly deems to be too hot.

On April 8th, the Shanghai Gold Exchange (SGE) advised gold margin requirements would be tightened from 10% to 12%, and the daily price limit would be adjusted from 9% to 11%. On April 12th, further adjustments were made. Starting from the close of clearing on April 15th, the margin requirement for gold contracts was increased from CNY 45,000 per lot to CNY 51,000 per lot. Similar adjustments were made to silver after it hit “limit up” on April 8th.

More importantly, on April 10th, the Shanghai Futures Exchange (SHFE or Shiffy) similarly announced the reduction of trading limits for gold futures, with a maximum number of contracts for intraday gold trading set at 2,800 lots. On April 16th, the SHFE further adjusted the daily price limit for gold and silver futures to 8%, while increasing the hedging trading margin requirement to 9% and the speculative trading margin requirement to 10%.

These changes provide significant speed bumps on the motorway that is gold trading. It is a passion-killer. It follows that Chinese speculators would look elsewhere.

Gold saw the largest price decline yesterday in 14 months followed by a further significant decline today with large volumes being traded in Shiffy.

There is a sense that the speculative froth is leaving the market and as it declines, gold will re-engage with its core physical buyers who have been left behind. If you want to know where that floor is then the charts will give you a view – and if not, Indian bargain-hunting is normally a great bell-wether. In short, this is a healthy correction for gold.

Rumours that the Chinese government would be building significant stockpiles of nickel sent prices up by a massive 6.5% on Shiffy, just as gold cratered … a coincidence ? I think not.

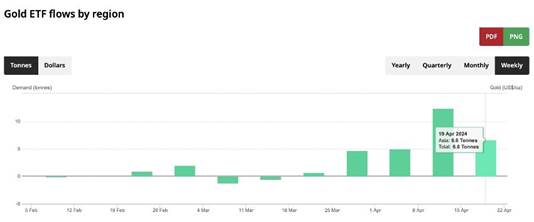

Meanwhile domestic Chinese gold ETF buying, normally the preserve of a footnote, has accelerated with 28.5 tonnes of gold buying in the last 4 weeks. So as speculators depart stage left, it appears that 'quality' gold investment is re-entering stage right. So grounds for encouragement.

Source: https://www.metalsdaily.com/