Page 39 - Bullion World Volume 03 Issue 07 July 2022

P. 39

ssue 09 | S

olume 5 | I

ep

ember

t

V

B

Bullion World | Volume 5 | Issue 09 | September 2025

ullion

orld |

W

2025

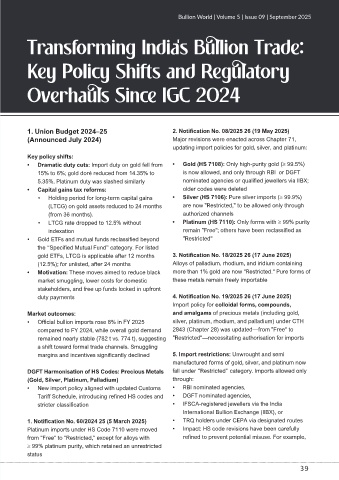

Transforming India's Bullion Trade:

Key Policy Shifts and Regulatory

Overhauls Since IGC 2024

1. Union Budget 2024–25 2. Notification No. 08/2025 26 (19 May 2025)

(Announced July 2024) Major revisions were enacted across Chapter 71,

updating import policies for gold, silver, and platinum:

Key policy shifts:

• Dramatic duty cuts: Import duty on gold fell from • Gold (HS 7108): Only high-purity gold (≥ 99.5%)

15% to 6%; gold doré reduced from 14.35% to is now allowed, and only through RBI or DGFT

5.35%. Platinum duty was slashed similarly nominated agencies or qualified jewellers via IIBX;

• Capital gains tax reforms: older codes were deleted

• Holding period for long-term capital gains • Silver (HS 7106): Pure silver imports (≥ 99.9%)

(LTCG) on gold assets reduced to 24 months are now "Restricted," to be allowed only through

(from 36 months). authorized channels

• LTCG rate dropped to 12.5% without • Platinum (HS 7110): Only forms with ≥ 99% purity

indexation remain "Free"; others have been reclassified as

• Gold ETFs and mutual funds reclassified beyond "Restricted"

the “Specified Mutual Fund” category. For listed

gold ETFs, LTCG is applicable after 12 months 3. Notification No. 18/2025 26 (17 June 2025)

(12.5%); for unlisted, after 24 months Alloys of palladium, rhodium, and iridium containing

• Motivation: These moves aimed to reduce black more than 1% gold are now "Restricted." Pure forms of

market smuggling, lower costs for domestic these metals remain freely importable

stakeholders, and free up funds locked in upfront

duty payments 4. Notification No. 19/2025 26 (17 June 2025)

Import policy for colloidal forms, compounds,

Market outcomes: and amalgams of precious metals (including gold,

• Official bullion imports rose 8% in FY 2025 silver, platinum, rhodium, and palladium) under CTH

compared to FY 2024, while overall gold demand 2843 (Chapter 28) was updated—from "Free" to

remained nearly stable (782 t vs. 774 t), suggesting "Restricted"—necessitating authorisation for imports

a shift toward formal trade channels. Smuggling

margins and incentives significantly declined 5. Import restrictions: Unwrought and semi

manufactured forms of gold, silver, and platinum now

DGFT Harmonisation of HS Codes: Precious Metals fall under “Restricted” category. Imports allowed only

(Gold, Silver, Platinum, Palladium) through:

• New import policy aligned with updated Customs • RBI nominated agencies,

Tariff Schedule, introducing refined HS codes and • DGFT nominated agencies,

stricter classification • IFSCA-registered jewellers via the India

International Bullion Exchange (IIBX), or

1. Notification No. 60/2024 25 (5 March 2025) • TRQ holders under CEPA via designated routes

Platinum imports under HS Code 7110 were moved • Impact: HS code revisions have been carefully

from "Free" to "Restricted," except for alloys with refined to prevent potential misuse. For example,

≥ 99% platinum purity, which retained an unrestricted

status

39