-

India's gold market sees dramatic price spikes, falling imports, and weak consumer demand in March – WGC

Fri April 26 2024

Skyrocketing prices squeezed consumers out of the local gold market and contributed to narrower discounts and weaker imports, but the country saw continued physical demand from investors and big purchases from the central bank, according to Kavita Chacko, Research Head for India at the World Gold Council (WGC).

Recent record-high gold prices were driven primarily by risk and momentum trades, Chacko noted in the latest WGC update, and this has been reflected on the subcontinent.

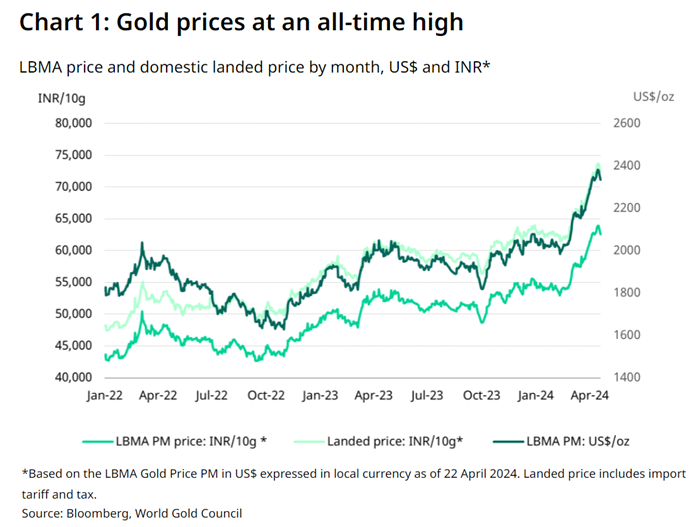

“Domestic landed gold prices in India mirrored the increase of international gold price or LBMA Gold price in March (up 8%), owing to the relative stability in the INR,” she wrote. “To date in April, however, the domestic landed price has risen by 4% (to INR72403/10g) versus 3% in the LBMA Gold Price, due to a depreciation in the INR (0.4%) against the USD.”

Chacko said that the speed and scale of gold’s rise has stifled domestic demand. “Anecdotal evidence suggests that the swiftness of the price uptick has affected gold consumption demand, particularly jewellery demand, which makes up around three-quarters of total consumption,” she said. “Additionally, most jewellery purchases are tied to wedding-related purchases. Also, consumers are awaiting stabilization in prices for fresh purchases and have been resorting to exchanging/selling old jewellery to benefit from windfall gains.” She added that demand has also likely been impacted by the national election and fewer weddings during the April-May season.

Conversely, physical investment demand, as reflected in bar and coin sales, has risen in anticipation of further price increases. “Some jewellers and manufacturers have been booking profits by liquidating stock and diverting gains to other investment avenues, but many are facing a liquidity crunch, limiting their ability to add to their inventories,” she said.

“Demand is unlikely to experience a meaningful uplift over the next couple of months, particularly while general elections take place (April to June), as the movement of gold and cash is closely monitored,” Chacko noted. “But some improvement in demand could be expected around the time of Akshaya Tritiya (10 May) if prices stabilise as this is traditionally considered to be an auspicious time to buy gold.”

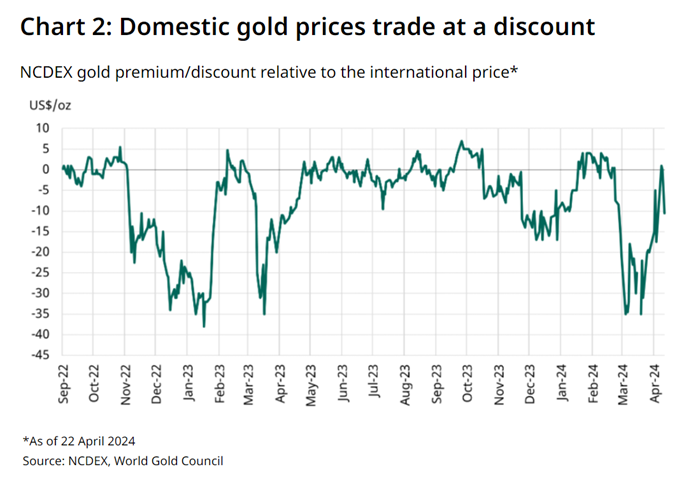

She wrote that domestic gold prices have continued to trade at a discount to international prices, though discounts are narrowing. “April saw India’s gold price discount averaging US$12/oz, down from US$24/oz in March,” she said.

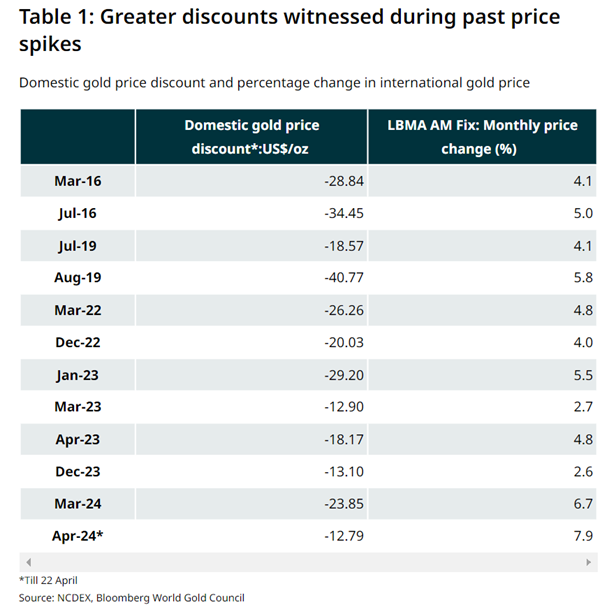

“Domestic gold prices often trade at a discount when international gold prices surge,” Chacko noted. “But compared to previous gold price spikes, the current domestic price discount is narrower (see Table 1), possibly indicative of pockets of gold demand here.”

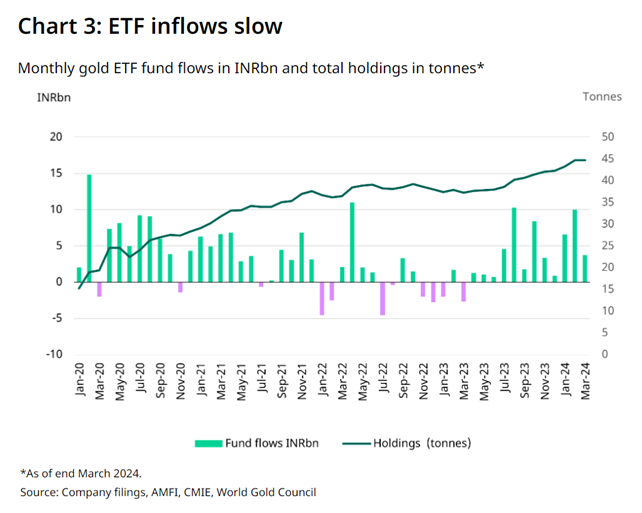

Turning to fund flows, Chacko said that Indian gold ETFs appear to be losing momentum. “Net inflows into the Indian gold ETFs totalled INR3.7bn in March, a significant (62%) drop from the substantial inflows of INR9.8bn in February – a six-month high,” she wrote. “This decline could partly be attributed to the quarter- and financial year-end payment requirements of investors. Indian mutual funds as a whole witnessed net outflows in March to the tune of INR1,593bn.”

“Despite lower net inflows, aided by the surge in gold prices, total assets under management (AUM) of gold ETFs at the end of March were up 9% m/m at INR312.2bn,” she said. “Collective holdings remained steady at 44.7t, although up 20% y/y.”

For fiscal year 2023-24 (April–March), net inflows into Indian gold ETFs were INR52.4bn, nearly nine times the INR6.5 seen in FY23, but still 24% below the record INR69.2bn in net inflows seen in 2020-21.

“The fiscal year 2023-24 has seen an 8% portfolio accretion or additional folios created,” she wrote. “This increase in folios and fund inflows can be attributed to the rise in gold prices, growing interest in tradable financial products, a significant uptick in capital market investments, the pursuit of investment diversification and geopolitical tensions.”

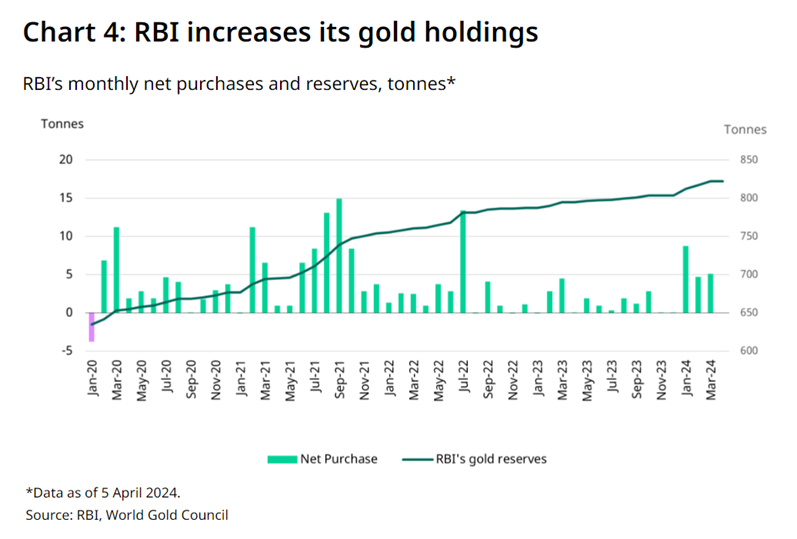

The Reserve Bank of India (RBI), for their part, has stepped up its gold purchases even as prices set new highs.

“The RBI continues to build its gold reserves at a steady clip,” Chacko noted. “RBI data and our own estimates indicate that its gold holdings rose to a record high of 822.1t by the start of April, representing an 18.5t net acquisition since the beginning of the year. The central bank’s net gold buying in 2024 has already surpassed its net purchases in 2023 (16.2t). As of early April, gold’s share of total reserves has risen to 8.4% from 7.7% at the end of 2023.”

She pointed out that the RBI is one of the bigger buyers among the central banks that have been driving gold purchases in 2024. “This continues the RBI’s trend of adding to its gold reserves and brings its net gold purchases to an annual average of 42t (between 2018 and 2023).”

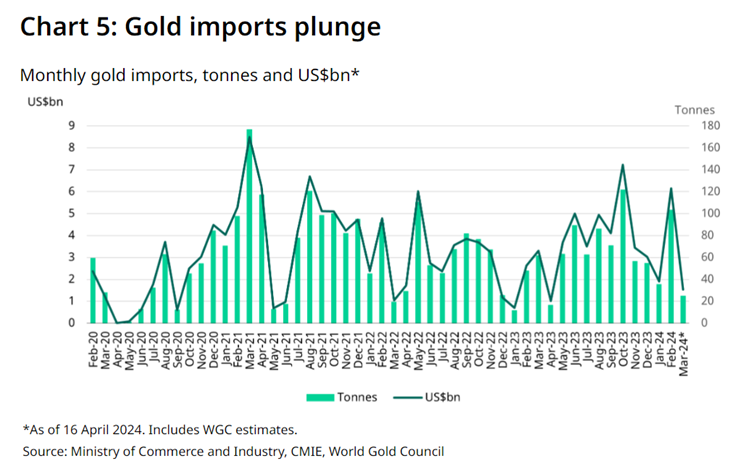

But outside the central bank, the country witnessed a sharp drop in gold imports last month. “At US$1.5bn, imports stood at a quarter of February’s total (US$6.1bn) and were the lowest in eleven months,” Chacko wrote. “This decline can largely be attributed to the record high prices (up 8% m/m). Furthermore, anecdotal evidence suggests that the price surge has spurred the supply of old or recycled gold in the domestic market; together with sluggish jewellery demand the need for fresh imports has lessened.”

According to the latest WGC estimates, gold imports in March were likely less than 30 tonnes, “significantly lower than the 104t imported in February and 62t in March 2023,” she said. “For the 2023-24 financial year (April 23 to March 24), gold imports saw an annual growth of 30% in value terms and an approximate 15% increase in volume terms. Monthly imports during the year fluctuated, varying between 16.7t and 121.9t (US$1.0-7.2bn).”

Chacko wrote that despite the year-over-year increase, gold imports in volume terms for FY23-24 “remained below the pre-pandemic five-year average (by 15-17%).”

Source: https://www.kitco.com/