Page 14 - Bullion World Volume 5 Issue 06 June 2025

P. 14

Bullion World | Volume 5 | Issue 06 | June 2025

Connecting India's Bullion Heartlands

With a vision to democratize bullion access, IIBX has expanded its presence across 83 districts in 20 states

and Union Territories. Over 600 Qualified Jewellers and Valid India–UAE TRQ holders have already joined the

platform, a strong testament to the growing trust in IIBX's operations.

Scaling Up Operations: Chennai Contracts & Trading Hours

In a significant operational leap, IIBX introduced Gold and Silver Spot T+0 contracts in Chennai on July 29, 2024.

These contracts allow same-day delivery via the J Matadee Free Trade Warehousing Zone (FTWZ) vault. With an

additional vault at Madras Export Processing Zone special Economic Zone (MEPZ SEZ) soon to be operational,

IIBX enhances logistical options for Qualified Suppliers and market participants, mirroring the flexibility currently

available in GIFT IFSC’s three vaults.

From May 1, 2025, IIBX further extended its trading hours from 09:00 to 21:30 IST, with BDR settlements every

30 minutes and four daily fund settlement cycles at 12:15, 15:15, 18:45, and 21:30 IST.

What's Next for IIBX

• Silver Futures – for hedging price risk.

• REPO on BDRs – enabling liquidity without physical bullion sale.

• Gold Metal Loans (GML) – enhancing liquidity and price discovery.

• BDRs as Investment Products – for Non Resident Indian (NRIs),

Person of Indian Origin (PIOs), and institutional investors.

• Fractionalized BDRs – broadening market accessibility.

• Gold Access for Exporters in SEZ & Domestic Tariff Area (DTA) – via a transparent procurement system.

• BDR-to-comRIS integration – seamless conversion to commodity receipts with Multi Commodity Exchange

• Vault Expansion PAN India – to support growing geographic demand.

Surging Volumes, Surging Trust

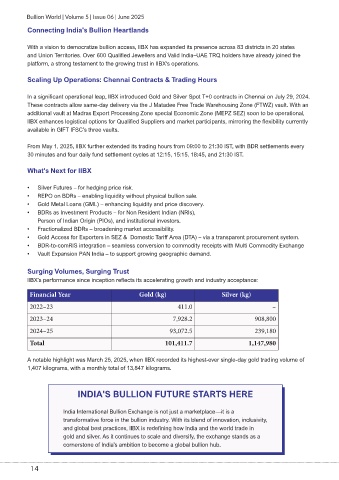

IIBX's performance since inception reflects its accelerating growth and industry acceptance:

Financial Year Gold (kg) Silver (kg)

2022–23 411.0 –

2023–24 7,928.2 908,800

2024–25 93,072.5 239,180

Total 101,411.7 1,147,980

A notable highlight was March 25, 2025, when IIBX recorded its highest-ever single-day gold trading volume of

1,407 kilograms, with a monthly total of 13,847 kilograms.

INDIA'S BULLION FUTURE STARTS HERE

India International Bullion Exchange is not just a marketplace—it is a

transformative force in the bullion industry. With its blend of innovation, inclusivity,

and global best practices, IIBX is redefining how India and the world trade in

gold and silver. As it continues to scale and diversify, the exchange stands as a

cornerstone of India's ambition to become a global bullion hub.

14