Page 9 - Bullion World Volume 3 Issue 1 2023

P. 9

Bullion World | Volume 3 | Issue 1 | January 2023

diverse demographic. The average age of the Indian workforce is expected

to be 32 years by 2030, giving us a broad window for skilled people The global slowdown

resources to power this growth in the long term. and its impact on

exports are likely

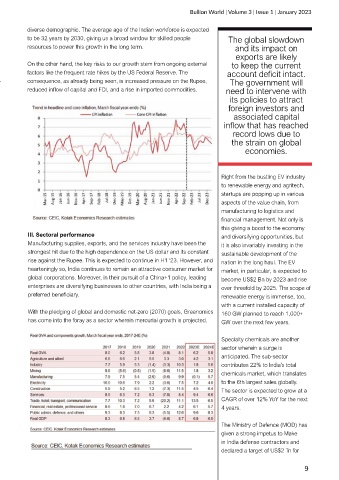

On the other hand, the key risks to our growth stem from ongoing external to keep the current

factors like the frequent rate hikes by the US Federal Reserve. The account deficit intact.

consequence, as already being seen, is increased pressure on the Rupee, The government will

reduced inflow of capital and FDI, and a rise in imported commodities. need to intervene with

its policies to attract

foreign investors and

associated capital

inflow that has reached

record lows due to

the strain on global

economies.

Right from the bustling EV industry

to renewable energy and agritech,

startups are popping up in various

aspects of the value chain, from

manufacturing to logistics and

financial management. Not only is

this giving a boost to the economy

III. Sectoral performance and diversifying opportunities, but

Manufacturing supplies, exports, and the services industry have been the it is also invariably investing in the

strongest hit due to the high dependence on the US dollar and its constant sustainable development of the

rise against the Rupee. This is expected to continue in H1 ‘23. However, and nation in the long haul. The EV

hearteningly so, India continues to remain an attractive consumer market for market, in particular, is expected to

global corporations. Moreover, in their pursuit of a China+1 policy, leading become US$2 Bn by 2023 and rise

enterprises are diversifying businesses to other countries, with India being a over threefold by 2025. The scope of

preferred beneficiary. renewable energy is immense, too,

with a current installed capacity of

With the pledging of global and domestic net-zero (2070) goals, Greenomics 160 GW planned to reach 1,000+

has come into the foray as a sector wherein mercurial growth is projected. GW over the next few years.

Specialty chemicals are another

sector wherein a surge is

anticipated. The sub-sector

contributes 22% to India's total

chemicals market, which translates

to the 6th largest sales globally.

The sector is expected to grow at a

CAGR of over 12% YoY for the next

4 years.

The Ministry of Defence (MOD) has

given a strong impetus to Make

in India defense contractors and

declared a target of US$2 Tn for

9